Media & Industry News

Scalable electronic trading on Google Cloud: A business case with BidFX

BidFX’s Liquidity Provision Analytics (LPA) solution is proudly featured by Google Cloud in their latest blog article. Learn how BidFX leverages Google Cloud to reduce its time-to-market and make electronic trading scalable.

Imagine you just got the restaurant bill and you can see only one number: the total cost, tip included. You have a sense you overpaid. Also what about this significant delay with service? Is it reflected in the tip? It’s difficult to answer these questions if you don’t have visibility into a breakdown of the costs.

This is very similar to the situation many market participants find themselves in the electronic trading industry. Transaction Cost Analysis (“TCA”) has been focusing for many years in the total “bill” of a trade or some components of it (e.g. bid-ask spreads), but hasn’t been providing visibility into other aspects such as market impact (e.g. did our trading volume impact the prices?), delay costs (also called “slippage”, remember this service delay at the restaurant?) and opportunity costs (maybe I should go for my second favorite dish if I know I have to wait too long for my first choice).

BidFX, a global FX multi-dealer platform collaborating with Google Cloud is trying to change this. “For a long time, everyone involved in the execution of financial assets has wanted to know how badly/well they’re trading. This has been done often in a non-differentiating way and is called TCA, whether to meet regulatory requirements or to add value by improving decision making. What we’re doing with our latest analytics is breaking that down even further to get to the real source of the costs being incurred. These tools work in facilitating a good marketplace for all participants.” says Daniel Chambers, Head of Data & Analytics at BidFX.

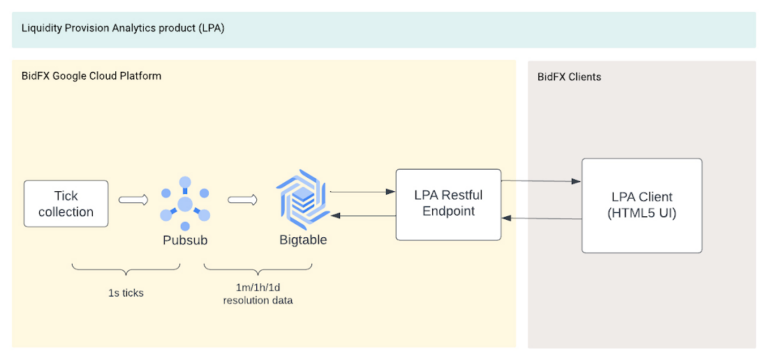

Working with Google Cloud, BidFX has been able to develop and deploy a new product called Liquidity Provision Analytics (“LPA”), launching to production within roughly six months, to solve exactly this industry challenge in an innovative way. LPA will be offering features such as skew detection for liquidity providers, execution time optimization, pricing comparison, top of book analysis and feedback to counterparties.

“For BidFX this is an important product as it places BidFX ahead of the curve in its industry. It is a type of analytics that many users within the industry will not currently be doing, but will add a lot of value to our clients.” mentions Chambers.

Leveraging Google Cloud’s data and analytics capabilities to tackle a complex business problem

The challenge: storing and serving FX time-series data in real time

BidFX’s LPA needed to store FX tick data and derived analytics at various resolutions (e.g. 1m, 1h, 1d). Each price data feed is defined by several fields:

- a client ID,

- a timestamp,

- the resolution (e.g. 1 min),

- the deal type (e.g. forward, swap etc.),

- the currency pair (e.g. GBPUSD),

- the liquidity provider (i.e. the origin of the quote),

- a tenor (i.e. the settlement date) and,

- the quantity to be traded.

Any results of slicing and dicing, aggregating or probing the analytics derived from these data feeds are served to BidFX’s clients globally through a front-end application. The main latency requirement of the platform was to be able to serve end-clients under 500 ms.

How did BidFX solve the challenge?

Building on Cloud Bigtable, Google Cloud’s fully managed, enterprise-grade NoSQL database service, BidFX’s LPA product can auto-scale seamlessly with no administrative or maintenance effort. The solution was able to achieve a back-end to front-end latency of ~35ms @50th and ~340ms @99th in the same geographic region, with availability of 99.999%.

““Leveraging the elasticity and operational efficiencies of Google Cloud allows us to reduce our time to market, delivering innovative, web-scale products in a lean manner while being confident we don’t encounter bottlenecks that require re-architecting at critical moments.”, says Maksim Korneichik, Data Engineering Manager at BidFX.

Figure: The LPA high-level architecture

This article was published on Google Cloud on 2 May 2023.