Technology

The best-in-class FX trading technology platform that delivers superior customer experiencePowerful technology solutions for the global FX marketplace in a single sign-on, cloud-based environment

Liquidity Aggregation

- Low latency FX price streams from banks, non-banks, inter-dealer brokers and ECNs

- Streaming spot, forwards, swaps, NDFs, metals and options

- All products also available via RFS

Model-driven Trading Strategies

- Back-test trading models from low to high frequency strategy

- Export comprehensive post-trade data sets for easy analysis

Optimising Execution

- Multiple order types

- Supports all tradeable CCY pairs

- Feature-rich GUI tailored to clients’ needs

- Point-to-point FIX sessions allow each liquidity provider to uniquely configure prices based on a specific event

Hosted Solution

- Market leading graphical user interface (GUI)

- Fast deployment

- Cloud-based software-as-a-service (SaaS)

- Built-in disaster recovery (DR)

- No IT infrastructure required

-

Global data centers

(London, New York, Singapore, Hong Kong, Tokyo and Paris)

Multiple Client Interfaces

- Market leading GUI

- HTML5 web version

- Excel spreadsheet environment for strategy trading

- Low latency FIX API trading

- Autoroute® enables automated, rule-based execution

- Mobile App

Risk and Compliance

- Pre-trade allocations and credit check

- Enforcement of broker restrictions

- Customisable trading limits

- Real-time fund and entity creation tool, managed by the customer

- Limits and alerts per CCY, broker, account, product, deal type and trader

- Automatically triggered emails at specific thresholds

Workflow Solutions

- Integration with leading order management systems (OMS), enabling seamless order staging and real-time straight-through-processing (STP)

Global Support

- 24-hour, 6-day a week customer support

- Providing regional insights into local market practices

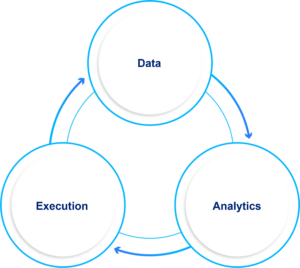

Data & Analytics

- Our class-leading Data & Analytics product suite offers a crucial feedback loop that enables a user to create pre-trade predictive models, in-trade benchmarking and post-trade synopses.

Data

- Spot, Forward and NDFs

- More than 60 currency pairs

G10, EM - Native and crosses

- All standard tenors

- Multiple quantities at each tenor

- Created from firm, tradeable market pricing

- Confidence levels for each price

- REST API or file delivery

- Collection and cloud storage of client-specific dedicated liquidity provider streams

- Spots, Forwards and NDFs

- Any currency pair and standard tenor can be requested

- REST API and GUI

Analytics

Liquidity Provision Analytics (LPA)

BidFX first coined the phrase Liquidity Provision Analytics in 2021 and is proud to be the main driver in this space.

- Compare liquidity provider pricing

- Detect skews from LPs

- Optimize execution time

- Provide feedback to counterparties by exporting analytics

- Top of book analysis

- Analytics every second

- Independent Benchmark (BidFX Composite) available for price comparisons

Advanced Transaction Cost Analytics (TCA)

In-depth analysis of trading performance versus unbiased proprietary price feeds, using a standard set of industry accepted benchmarks.

- Multiple Benchmarks

- Cost Attributions

- Real-time & Historical

- Market Impact Analysis

- Intra and Post TCA

Execution

- Auto-router

- Algo wheel

- Liquidity management

- Shaping & netting