Solutions

The trusted turnkey trading solution for the eFX market

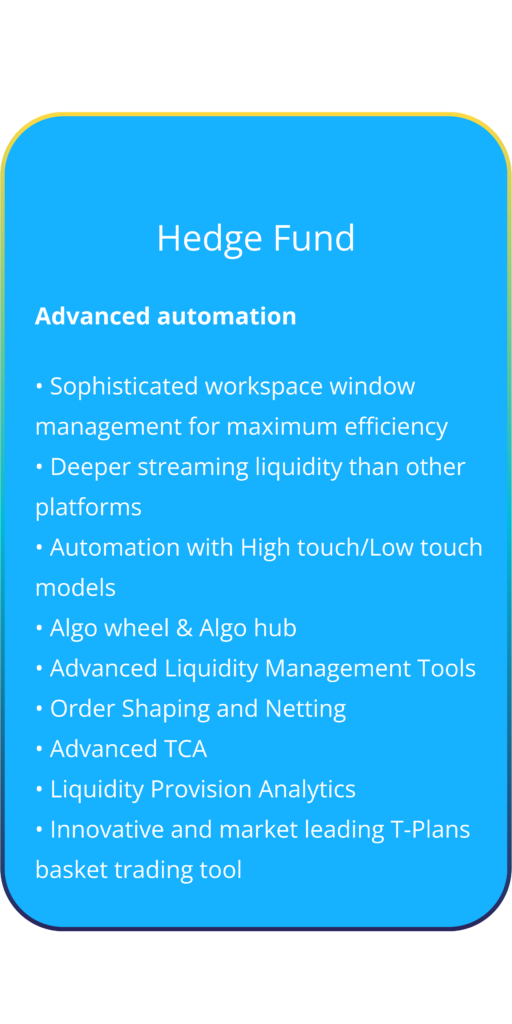

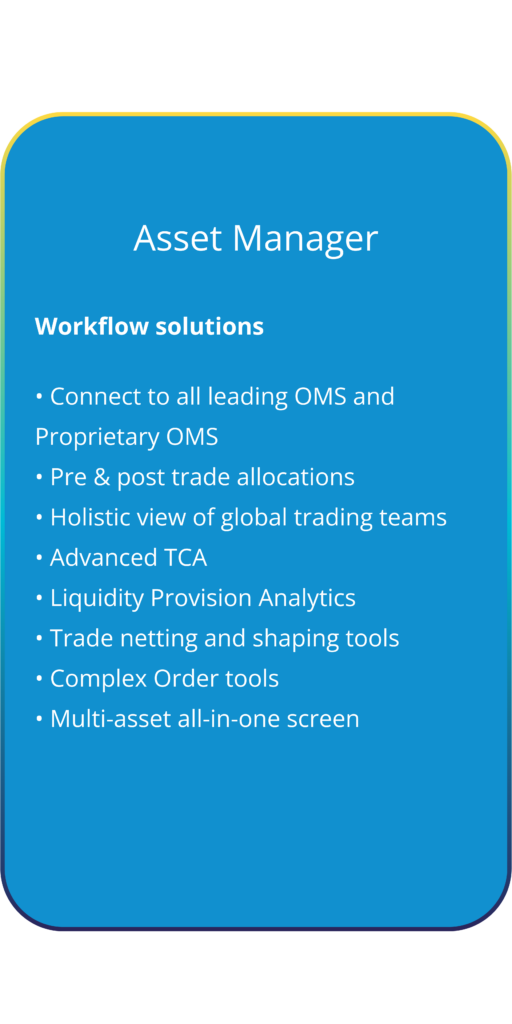

We are trusted by over 200 of the world’s largest banks, hedge funds, corporates and asset managers as their primary FX trading platform. Our platform achieves optimized workflow efficiency and simplified user experience, all within a single sign-on, fully secure, cloud-provisioned environment.

Enhancing Efficiency and Maximizing Profitability

Whether you work for a Hedge Fund, Asset Manager, Corporate Treasury Desk or any other buyside, our platform empowers you to achieve optimized workflow efficiency and a simplified user experience.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Conduct seamless operations such as currency exchanges and funding for essential tasks.

With a focus on minimizing costs and executing trades at the right time, our workflow solutions enable traders to efficiently aggregate all trades, resulting in significant savings on transaction expenses.