BidFX recently launched its Liquidity Provision Analytics (LPA) product suite for customers, Colin Lambert talks to Daniel Chambers, head of data and analytics at the firm, about what it is trying to bring to market.

The combination of the FX Global Code bringing more awareness of counterparty behaviour, and the rise of data and analytics has created what could be termed a marriage of coincidence in that customers are more aware of the impact of their business, and are starting to open up to the practice of using the data and analytics to monitor said impact. This has seen the relationship model in the FX industry shift from one dominated by voice and market colour to one using data to analyse behavioural trends on both sides of the divide.

Not all buy side firms have the resources to fully utilise and analyse the ever-increasing amount of data generated by markets businesses, however, and into this gap has stepped BidFX with its Liquidity Provision Analytics (LPA) product. Recently launched, John McGrath, Chief Revenue Officer at BidFX, says the response to LPA has been positive, something reinforced by Nick Wood, Head of Execution at Millennium Global (comprised of Millennium Global Investments and MillTechFX) who says, “For some time many market participants have been interested in best execution and TCA and at Millennium Global we like to build on this and go a step further to the real source of costs being incurred. The LPA tool assists us in this challenge and allows us to work towards curating the best market for us and our clients”

“This is really about building and strengthening the relationship between client and LP in a more focused fashion”

McGrath observes, “We recognise that there is a real spectrum of sophistication in market participants, so for some clients, even if they have the data, it’s quite a lot of work to then query it, store it, and produce good analytics. It takes time money and resources that not all firms have available.”

Daniel Chambers is head of data and analytics at BidFX, and he says the firm is seeking to expand upon the traditional TCA product offering, leveraging its position as a technology provider, to sit in the middle of buy and sell side “to facilitate a market that works for both”.

In order to do this, Chambers says LPA offers a picture of what liquidity looks like for a customer, in terms of spreads, skews, and decays, to give them more visibility on what their liquidity pool actually looks like. “This also allows the client to provide feedback to the LP, which hopefully encourages better liquidity, Chambers explains. “This can help facilitate more conversations in the hope that the flow is less toxic for the LP. In turn this can help reduce information leakage for the client.”

To power LPA, a liquidity consumer merely informs BidFX of the universe of instruments they are interested in -sizes, currency pairs, tenors and LPs. BidFX then captures the pricing sent to the client, including skews, to provide the foundation for the analysis. “That data is then made available in a couple of different ways,” explains Chambers. “It’s there to help them with back testing, as well as with comparative analysis.”

Functionality

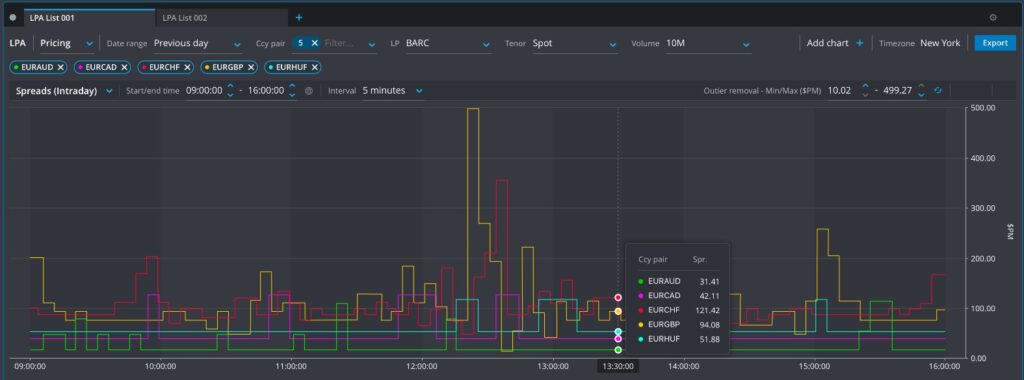

LPA sits on the BidFX platform, therefore is available on the same solution and has the same look and feel, helping, the firm hopes, to provide clients with a familiar experience whether they are trading, slicing and dicing data, or receiving analytics from the platform. High level data is displayed, but users are able to filter by tenors, LPs, and currency pair, as well as by size of trade. They are able to drill down from this, however, for example they can see how much time an LP is top of book in various pairs, and at what time of day. Other more granular analysis includes LP spreads by currency pair, including whether an LP prefers pricing crosses “directly” or through the legs, as well as how they are pricing the curve in different quantities – to help understand whether an LP is, for example, often at top of book but not in large quantities?

Users are also able to analyse skew, which involves BidFX measuring an LPs bid and offer at each snapshot, with a comparison of how far away from the platform’s best composite bid-offer each LP is. If they are 0 they are the best bid or offer. “This allows the LPs to understand that while they may not be the tightest for a client, their skew often gets them to top of book,” explains Chambers. “From the client perspective they are very unlikely to be interact with an LP that never gets to 0 because they are never best price in that quantity or pair, but the skew analysis really helps them understand how they interact with each LP.”

Although LPA is flexible in terms of the time horizons clients can apply, another drill down available is analysis of monthly LP performance. “We take a date range of a month for example and apply filters to get an idea of the intraday profile over the month,” says Chambers. “By holding the cursor over a point in time with the pair or pairs selected, LPA provides the average spreads from different LPs at that time over the course of a month.

“This means clients can quite quickly see, for example, that LP1 is sitting wider at that time over the course of the month,” he continues. “This allows clients to see LPs strengths in certain regions, as well as provide a good picture of liquidity over a typical day.”

Execution Assistance

Perhaps the most intriguing aspect of the LPA service is how it allows clients to interact during an execution, thus introducing elements of “in-flight” TCA. BidFX typically snapshots data at one-second intervals, it can do so over a set period of time if the client requires and can do so more frequently, and then plots that on the LPA screen.

“LPA shows client in real time how their LPs are performing,” Chambers explains. “They can see what any LP’s skew looks like and how they are performing, which helps inform their ongoing execution.

“This is on-the-fly analysis, which shows what we deem skew to look like,” he continues. “If, for example, a client is going to chop a trade up over the next hour, if they can see someone skewing in the client’s favour to reduce the LP’s risk, they can accelerate their hedging by trading with that LP. At the same time, they can monitor the skew for any changes, and adjust their trading speed accordingly.

“Hopefully by displaying the skew, LPA is helping take the LP out of risk, as well as reduce market impact for the client,” Chambers adds. “It is somewhat dependent on how the LPs provide skew, they can still create information leakage, but we hope uses like I just described can help improve the situation for both sides.”

Strengthening Relationships

The ultimate aim of LPA is to strengthen existing relationships between buy and sell side, to which end, Bid FX has enabled clients to export the analytics and effectively un-anonymise one LP of several. This allows a client to share comparative analytics with one LP, without revealing the identity of the others in the pool.

“There so much more visibility clients can have on their business, because traditionally we have focused so much on execution costs,” observes Chambers. “That has expanded into trying to improve execution costs, but most of the time, this data is point in time or historic. By providing a live insight into liquidity conditions for one client at a certain point in time, LPA empowers the client to trade in a more informed fashion.

Looking ahead, Chambers says BidFX plans to include decay analysis – which is currently available in other reports from the platform – in the GUI, to allow clients to assess information leakage. This will be represented on a heat map, thus making it easier to identify trouble spots. The mark outs will be assessed against BidFX benchmarks for execution, which includes all trades and prices on the platform, across all clients.

“The differentiator for us is that third party providers are not capturing dedicated pricing to a specific client, they are more generic, whereas we are providing specific analysis for a specific client,” Chambers says. “This is really about building and strengthening the relationship between client and LP in a more focused fashion.”

This article was published on The Full FX on 23 March 2023.