From The Management

Where’s the e-FX marketplace heading?

As we look back of the days of cigarette smoke filled trading rooms, with arms waving for ‘bids’ & ‘offers’, where a blue shirt just wasn’t ‘cricket’ as they say, we’ll realise just how far we have come with the advent of technology, and just how far trading has evolved as a result. Every coin has two sides though, so whilst processes have become exponentially more efficient, unfortunately there has been a toll taken on sell side headcount in particular, with quants taking the places of elements of sales & trading, as pricing engines take control progressively. That’s all very much known and understood from the sell side, but from the buy side, we’re seeing a steady shift, even from the most traditional sides of the marketplace. The old adage of ‘$500 mine… if you buy me lunch’ clearly has evaporated in the age of regulatory scrutiny, best execution & Mifid II. Instead we’re seeing a shift relatively in line with this: phone –> screen -> Algos -> API -> machine learning -> where next?

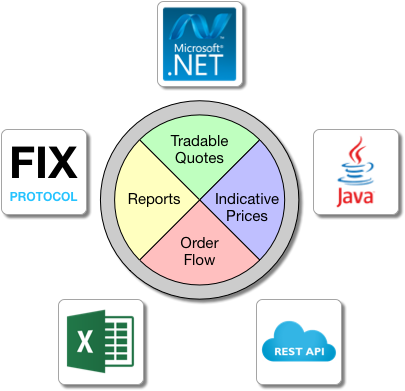

Now it seems relatively clear that long only clients are moving towards centralised dealing desks, becoming execution desks that cater for Equites, Futures, FX & Fixed Income as one team, be it multi region or not. Trading technology firms such as ‘BidFX’ (the newly created FX technology firm, wholly own by TradingScreen) have also come a long way, in effectively becoming a type of supermarket, from where a client can go to a shelf and pick and choose what type of solution they want, what deal types they want to trade, what brokers, what algos, what compliance features. In a similar way with the parent firm, TradingScreen’s clients also choose which asset classes, which banks / brokers, what type of workflow, what type of risk & or compliance they want, and what type of TCA (Transaction Costs Analysis).

The important thing to realise though is that ‘screen’ trading is not the final step in this trading technology ‘evolution’. Indeed our leveraged clients clearly find that a combination of screen & API is becoming progressively more ‘de rigeur’. To that extent I thought it somewhat useful to remind our community that API is an area that BidFX is well versed in, & you’d be surprised to know to what extent & the variety of options that are available, (summarised in the graphic above), so let us know.. sales@bidfx.com. In our eyes ‘curiosity never killed the cat’, they have too many lives, so don’t be shy!